delayed draw term loan definition

Us Financing guide 12. Danh sách các thuật ngữ liên quan Delayed Draw Term Loan Definition.

Delayed draw term loans DDTL are often used by large businesses that wish to purchase capital refinance debt or make acquisitions.

. This Credit Agreement dated as of August 31 2012 is among Par Petroleum Corporation a Delaware corporation Borrower the Guarantors party hereto from time to time together with the Borrower each a Credit Party and collectively the Credit Parties the lenders party hereto from time to time the Lenders and. 137500000 DELAYED DRAW TERM LOAN FACILITY Table of Contents Page. The withdrawal periodssuch as every three six or nine monthsare also unwavering in advance.

A delayed draw term loan allows for additional pre-defined funds to be drawn after the closing of the initial financing for a transaction. Term debt has a specified term and coupon. DDTLs were used in bespoke arrangements by borrowers who wanted to get incremental committed term loan capacity often for future acquisitions or expansions but wanted to delay the incurrence of the additional.

Examples of Delayed Draw Term Loan in a sentence. Proceeds from the planned issuance along with a 350 million revolver draw and previously committed 11 billion delayed draw term loan will be used to fund a 22 billion distribution to. The revolving loans are approved for the short-term usually up to one year.

Nội dung bài viếtKhoản vay có kỳ hạn rút tiền trả chậm là gìTìm hiểu về Các khoản cho vay có kỳ hạn trả chậmTóm tắt ý kiến chínhCác cân nhắc đặc biệt của DDTL Khoản vay có kỳ hạn rút tiền trả chậm là gì. Thuật ngữ tương tự - liên quan. Define Delayed Draw Term Loan Expiration Date.

Their appeal is one reason borrowers have moved toward the private debt market sometimes at the expense of syndicated loans. Historically delayed draw term loans DDTLs were generally seen in the middle market non-syndicated world of leveraged loans. Khoản vay có kỳ hạn trả chậm DDTL là.

Delayed-draw term loans or DDTLs of up to two years are standard features of financing from private credit providers. Define Delayed Draw Term Loans. The way a delayed draw loan works is that the lender and borrower agree to whats called a ticking fee representing a fee the borrower pays to the lender during the period of time the borrower can use the undrawn value of the loan.

ARTICLE I DEFINITIONS AND ACCOUNTING TERMS. A delayed draw term loan DDTL is a special feature in a term loan that disillusion admits a borrower withdraw predefined amounts of a total pre-approved loan amount. All Delayed Draw Term Loan Fees shall be computed on the basis of a 365 day or 366 day as applicable year for the actual number of days elapsed and shall be paid in Dollars.

Has the meaning assigned to that term in Section 25. DELAYED DRAW TERM LOAN CREDIT AGREEMENT. Refers to the loans that the Lender has agreed to be made available to the Borrower under a Revolving Credit Facility or a Delayed Draw Term Facility that the Borrower has either not drawn or has drawn and repaid.

The loan is terminated by the borrower. The Delayed Draw Term Loan Commitments are not revolving credit commitments and the Borrowers shall not have the right to borrow repay and. The ticking fee is due until.

The coupon may be fixed or based on a variable interest rate. A delayed draw term loan is a special feature in a term loan that stipulates that the borrower can withdraw predefined amounts of the total pre-approved amount of a term loan at contractual times. In the years of strong credit markets prior to the COVID-19 pandemic documents governing DDTLs.

The lenders approve the term loans once with a maximum credit limit and charge variable interests on them. Unless the context requires otherwise i any definition of or reference to any agreement instrument or other document herein shall be construed as referring to such. Đây là thuật ngữ được sử dụng trong lĩnh vực Ngân hàng Khái niệm cho vay cơ bản.

Both Church Corporation and Contractor understand and agree that Contractor is at all times and shall remain an independent contractor in. Delayed Draw Term Loan Commitment Termination Date means the earliest to occur of i December 31 2008 ii the date the Delayed Draw Term Loan Commitments are permanently reduced to zero pursuant to Section 21 and iii the date of the termination of the Delayed. Provided that any Loan as to which no further.

A revolving loan comes with a replenishing feature where the borrower can withdraw amounts and repay to fully utilize the facility again. The full value of the loan is used up. A draw period is the amount of time you have to withdraw funds.

With a DDTL you can withdraw funds several times from a predetermined loan amount. DEFINITION A delayed draw term loan is a type of loan where borrowers typically business owners can request additional funds after the initial draw period has come to an end. Upon issuance the issuer recognizes a liability equal to the proceeds eg cash received less any allocation of proceeds to other instruments issued with the debt or features within the debt instrument itself.

A delayed draw term loan also referred to as DDTL is a. The withdrawal periods are also determined in advance. Tranche A Term Loan means a Loan made pursuant to clause a of Section 201.

Delayed Draw Term Loan Definition là Trì hoãn Draw vay Term Definition. Means the earlier of i the first anniversary of the Closing Date or ii the date as of which the Delayed Draw Term Loan Commitment has been fully utilized in accordance with the terms of Section 201b. An accordion feature is a type of option that a company can buy that gives it the right to increase its line of credit.

Thuật ngữ tương tự - liên quan. Delayed Draw Term Loan Definition là gì. 122 Debt issuance costs.

Undrawn Commitment Banking Finance Glossary Summary.

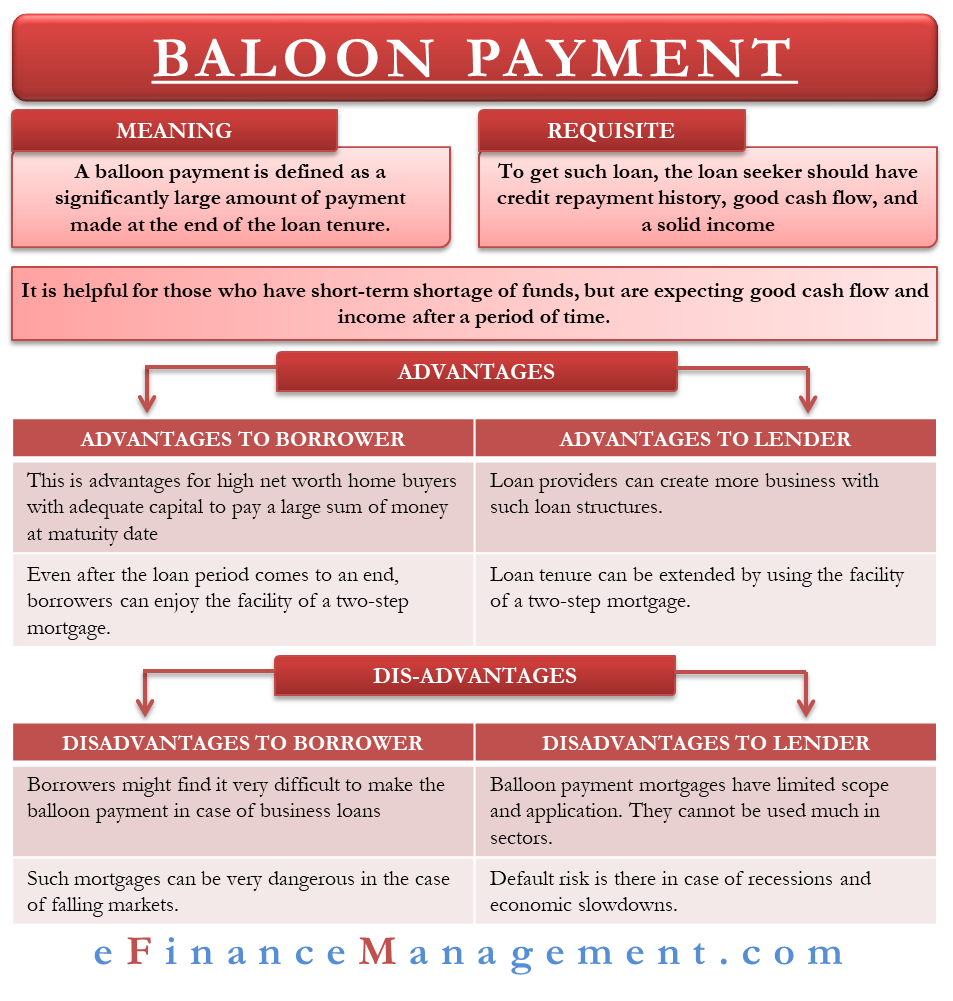

Balloon Payment Structure Meaning Usage Advantages Limitations

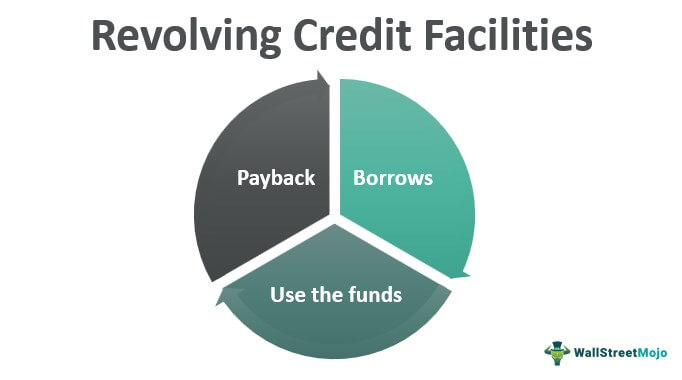

Revolving Credit Facilities Definition Examples How It Works

Delayed Draw Term Loan Ddtl Overview Structure Benefits

:max_bytes(150000):strip_icc()/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

Line Of Credit Loc Definition Types And Examples

Types Or Classification Of Bank Term Loan And Features Lopol Org

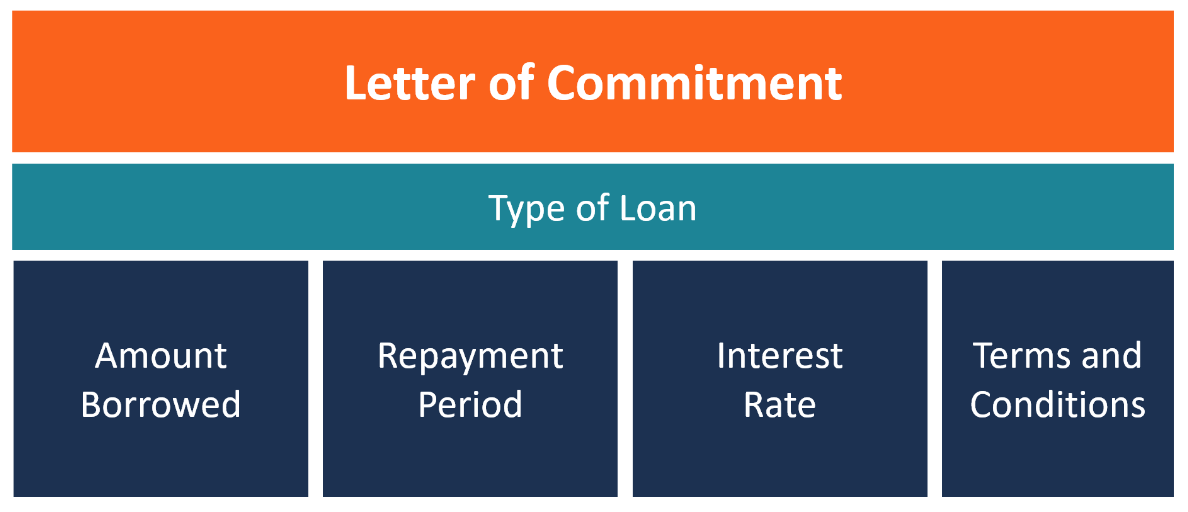

Letter Of Commitment Overview Example And Contents

Pdf The Importance Of Long Term Financing By Banks Advantages And Future Challenges

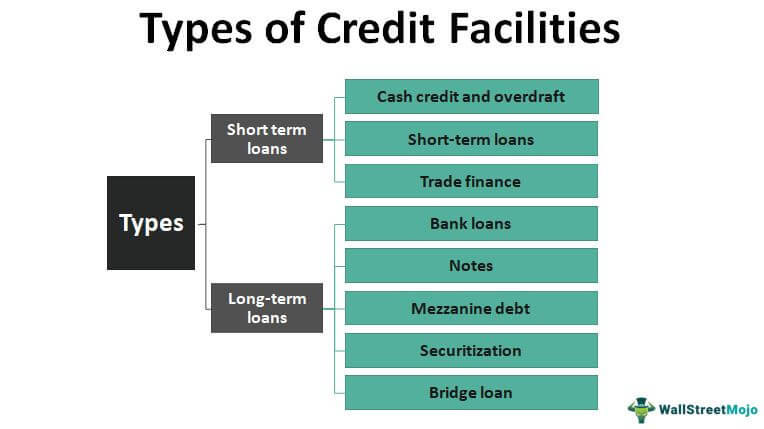

Types Of Credit Facilities Short Term And Long Term

Revolving Credit Facility Efinancemanagement

Delayed Draw Term Loans Financial Edge

Financing Fees Deferred Capitalized Amortized

Long Term Debt Types Benefits Disadvantages And More Money Management Advice Personal Finance Organization Personal Finance Advice

:max_bytes(150000):strip_icc()/dotdash-whats-difference-between-grace-period-and-deferment-Final-f578b305f5764f19bce7046a690b71e0.jpg)

Grace Period Vs Deferment What S The Difference

الى الآن حصن ابتكر Advantages And Disadvantages Of Short Term Sources Of Finance Daydreema Com

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/DrawDown-72a632110a47496a9fa346b7c63eb557.jpeg)

What Is A Delayed Draw Term Loan Ddtl

الى الآن حصن ابتكر Advantages And Disadvantages Of Short Term Sources Of Finance Daydreema Com

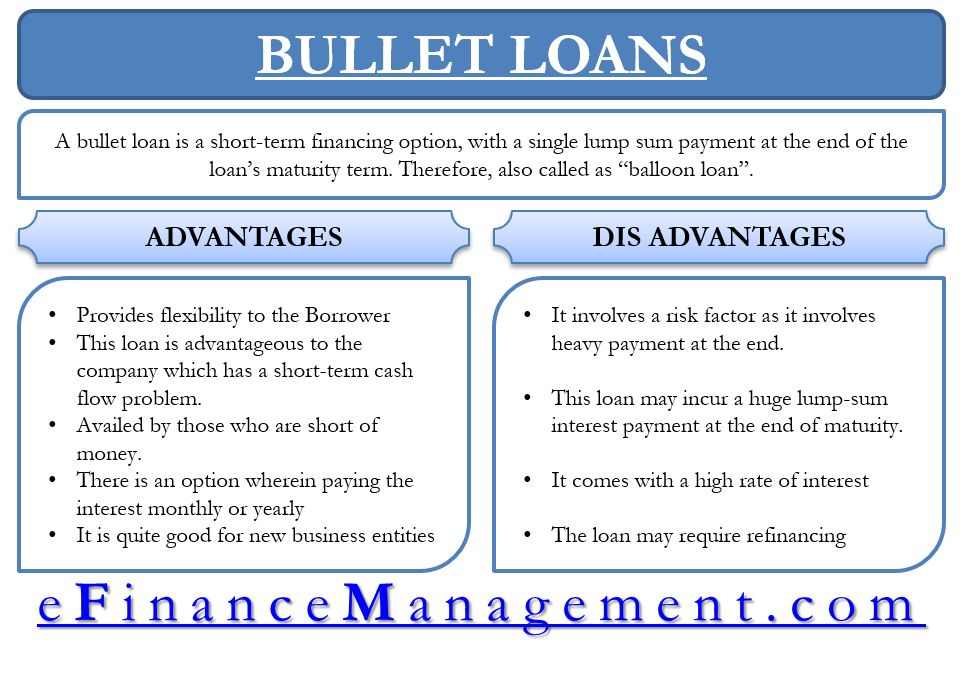

Bullet Loan Efinancemanagement

Loan Structure Overview Components Examples

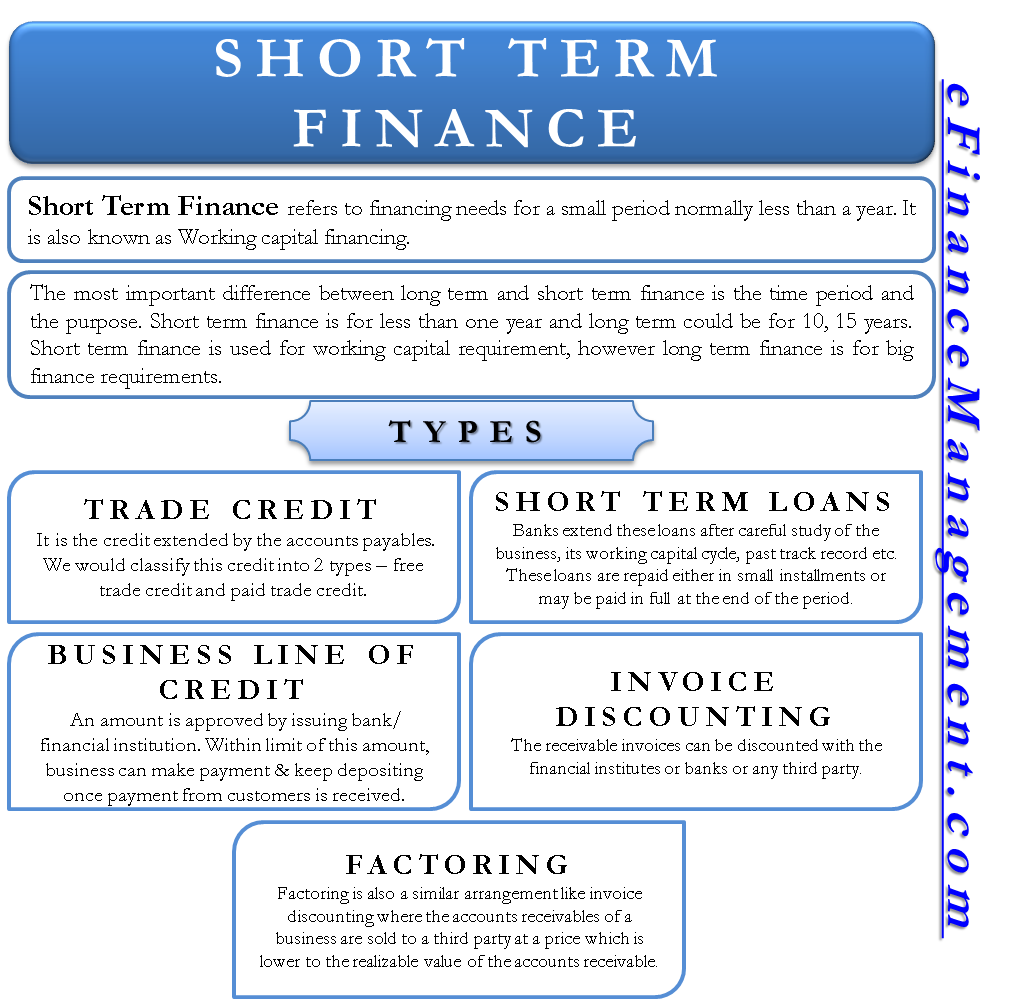

Short Term Finance Types Sources Vs Long Term Efinancemanagement